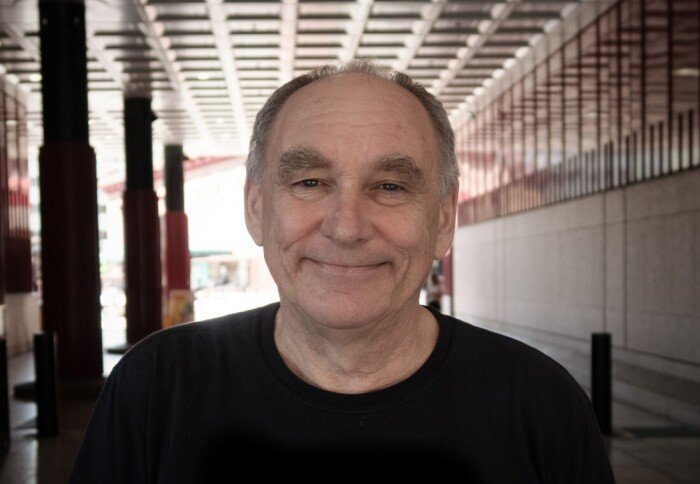

Neema Raphael left San Francisco in 2003, and headed to New York to use his tech know-how to the enterprise sector. He quickly landed a job at Goldman Sachs, and inside 5 years, the self-confessed “tech nerd”, who knew nothing in regards to the finance sector, was a part of a group serving to the banking big survive one of many largest crises it has ever confronted.

Raphael says he’s a “Californian child” who grew up in Los Angeles and accomplished his undergraduate tech training on the College of California in Berkeley.

After graduating in laptop science in 2003, he instantly headed to New York, the place he joined Goldman Sachs for what he describes as his first and solely job. “I used to be learning laptop science, which I like as I’m a tech nerd, however I wasn’t positive if I wished to do pure tech for tech, and I wished to study one thing knew,” says Raphael.

He says he knew nothing in regards to the finance sector, however had accomplished a few internships at Goldman Sachs in San Francisco. “The finance sector appeared a like a cool technique to marry my tech expertise with a brand new area,” says Raphael.

After interviews at Goldman Sachs in New York, he says he was “completely offered” on the concept. Raphael was 22 yr outdated, and started his journey as a pc programming analyst, the place he coded back-office accounting techniques.

But it surely was in 2008 that he actually minimize his tooth, within the financial institution’s IT division. “The monetary disaster hit and folks have been truly frightened about whether or not the agency would [continue to] exist,” he says. This was simply after the collapse of funding financial institution Lehman Brothers.

Raphael tells Pc Weekly: “There have been a couple of teams that got here collectively from completely different elements of the agency to attempt to convey firm knowledge collectively. Information about our publicity to Lehman Brothers, about how our enterprise is working, our each day danger to get a extra holistic view of how the agency was doing and our publicity. I used to be put into this type of swat group constructing a database.”

Award win The database, referred to as Cptyr, gained a prestigious award on the financial institution. Raphael says this was uncommon as a result of it will usually go to the very best banking or gross sales transaction slightly than an IT venture. “The database gained the award,” he jokes. The primary iteration of the database took weeks, however it continued to be developed to help the enterprise. “The database not solely helped save the corporate however grew to become a enterprise driver,” says Raphael. Completely different elements of the Goldman Sachs enterprise, together with salespeople, merchants, and quants started to method the group to seek out out extra in regards to the database that brings collectively all the info they want in a single place. “That is the place my knowledge focus and fervour got here in,” he provides. Goldman Sachs has three enterprise arms: funding banking and gross sales and buying and selling, asset/wealth administration and personal wealth, and a 3rd enterprise referred to as Platform Options, which focuses on fintech and digital transactions. Raphael’s present function, which studies into the chief expertise officer, covers all three. Every enterprise line has its personal engineers who’re supported by his “horizontal group”, which builds platforms for all enterprise verticals. The group is made up of about 500 tech professionals out of Goldman Sachs’ whole tech workforce of 12,000, a couple of quarter of the corporate’s whole workers. In his present function, Raphael says the largest problem is coping with the “explosion of information and what folks need to do with it”. “Finance has at all times been closely knowledge pushed, however now it’s much more essential with machine studying, so my largest problem throughout the agency is organising knowledge in a sane approach that folks can faucet into, and to ensure it may be used for issues like buying and selling, making selections and conferences laws. “We now have to ensure the info is organised, clear and high-quality, and ensure non-techies in addition to techies can use it,” says Raphael, including that knowledge on the financial institution is “medium-sized however extremely complicated”. “The complexity of our knowledge is the problem that makes it tremendous fascinating right here, not the quantity, as we’re not an online scale firm,” he says.